Since the pandemic began, many key factors for the financial viability analysis of photovoltaic (PV) solar energy projects are no longer the same. As of 2021, trends that had been consistent for a decade are now lagging. Some assumptions that were commonly accepted in the industry for projecting the future performance of PV solar projects have been reassessed based on operating experience and current data.

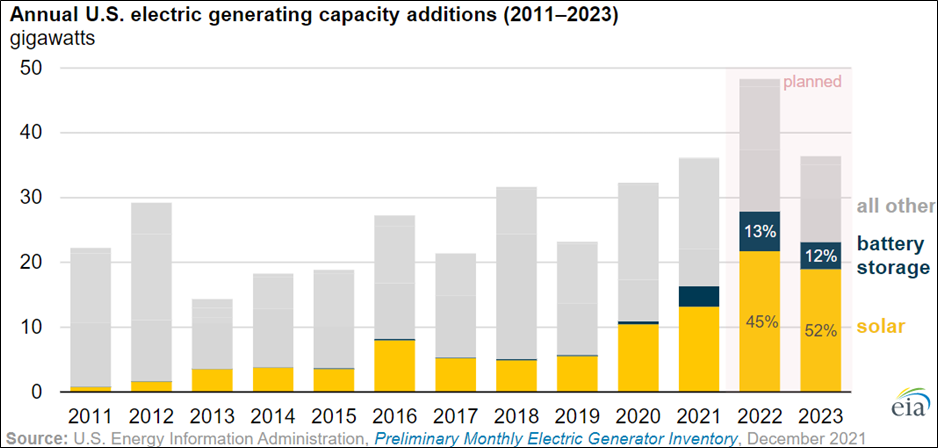

The good news is that growth records for installed solar capacity were exceeded again and the boom is expected to continue in the coming years. As noted by the United States (U.S.) Energy Information Administration (EIA) [1], the planned solar energy exceeds 50% of the total U.S. electric generating capacity additions in 2023. (See Figure 1)

However, recent data and analyses released by industry associations and industry-recognized analysts indicate that lenders and investors should pay special attention to significant changes in the PV solar trends for a more realistic evaluation of new and existing solar projects.

The amount of data, forecasts and projections published by analysts and specialized media at the beginning of the year can be overwhelming and diffuse. In this article, we summarize our view on three of the most relevant factors that impact investment decision-making that changed in 2021, based on information published from December 2021 through the first quarter of 2022.

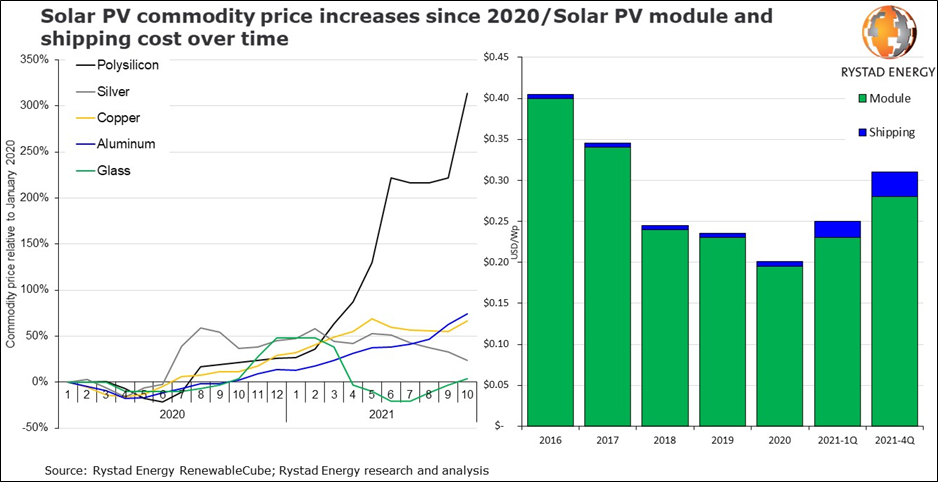

#1 – Supply ChainUnlike previous years, it can no longer be taken for granted that solar panels costs will only decrease. In mid-2021, the price of solar panels rose after almost a decade of continuously falling prices. This increase was mainly due to the rise in two fundamental cost components, as denoted by Rystad [2]: 1) the cost of solar-grade polysilicon, the raw material for the wafers that make up the solar panels, skyrocketed, and 2) the increase in shipping costs from China due to the international container shipping crisis. (See Figure 2)

According to a recent statement (March 2022 at the Solar Finance and Investment Europe (SFIE) event in London) the head of market research at Solar Media, cited by PV-Tech [3], pointed out that “module prices are to remain elevated for the next 18 months at least, with any additional manufacturing capacity set to be quickly swallowed by soaring demand and capacity addition outside of China considered risky.”

Regarding the container shipping problem in 2021, shipping costs increased nearly five times on average. The demand for the container market is still strong in 2022 and is expected to continue to be elevated until 2023, according to BIMCO (The Baltic and International Maritime Council, one of the largest international shipping associations representing ship owners) cited by GMDH [4].

- A more rigorous validation of firm proposals or contracts supporting project cost estimates is required. The assumption that was being used until 2020 that costs would only go down is no longer valid

- Separately run sensitivity analyses of the financial model for variations in price and shipping costs of major components.

The rapid pace of growth in installed solar capacity and integration in electricity markets has put a strain on not only the global supply chains, but also approval of new interconnection points, causing delays in the implementation of new projects. We see, therefore, two main groups of causes for the observed delays in project implementation.

First, the backlog in the manufacture of main components such as solar panels and inverters and the logistics of transport from Asia to Europe (EU) and U.S. markets. In North America, according to the IHS Markit Data "North America Solar PV Capital Cost and LCOE Outlook, January 2022," supply chain constraints and shipping delays are expected to raise the levelized cost of electricity (LCOE) for PV solar in the near term, up to 10% in 2021-23, after which costs decline in the mid-2020s, driven by incremental technology improvements and scale, and reach new lows by the early 2030s despite the step down in the federal tax credit [5].

Second, the interconnection queues and the growing demand for studies required for interconnection approval, which leads to delays in the process and an increase in interconnection costs. For example, according to the IHS Markit Insight "Interconnection woes across the Mid-Continent," the cost of interconnecting new generation in the Midcontinent Independent System Operator and Southwest Power Pool regions can vary extensively, indicating that although most projects that complete the queue process have interconnection costs less than $100/kW, some other solar projects have interconnection costs greater than $1,000/kW [5].

- A more rigorous validation of project implementation schedules is required.

- Separately run sensitivity analyses of the financial model for variations in expected times to get interconnection approval and interconnection costs.

As access is gained to more data accumulated by installed projects that add up to more years of operation, it has been possible to verify some discrepancies between the technical and operational assumptions considered in models used for financial closure and the actual performance of the projects. Following are comments on recent changes in industry-accepted assumptions regarding three essential operating assumptions for projecting the future performance of solar PV projects, extracted from kWh Analytics report [6].

Degradation. A widely accepted assumption for PV solar systems’ yearly degradation has been -0.5%, based on a National Renewable Energy Lab (NREL) study published in 2016. However, data from more recent research from NREL, Berkeley Lab, and kWh Analytics indicates that the 2016 assumption is outdated and underestimates degradation by up to 0.5% annually in some cases. Those updated studies show that system-level degradation ranges from 0.72% to 1.20% per year, depending on the market segment (residential, commercial and Industrial or utility-scale).

Inverter Availability. Research data on the performance of different inverter manufacturers within a managed fleet shows that, contrary to the assumed standard of 99% availability, actual inverter availability is around 95% for inverters whose original equipment manufacturer (OEM) remains active in 4 the market and points out that in the case of inverters without original manufacturer spare parts support (defunct OEMs), their availability may drop to approximately 85%.

Soiling. According to an analysis presented by Fracsun, a photovoltaic module soiling measurement and management company, virtually all soiling estimates made by independent engineers during the development phase for initial project modeling resulted in underestimating or overestimating the soiling in comparison to actual measurements made with instruments in the field. Although this finding is not surprising, it brings to attention the convenience of using comprehensive soiling datasets whenever possible to reduce the financial risk inherent in the deviation of the results of the initial development model.

- In projects that are still in the process of being financed, key technical and operational assumptions in the proposed economic models should be vetted against real industry performance trends.

- In projects that are already in the commercial operation phase, it will be important to review assumptions in the operating plans and budgets or implementation of preventive actions against risks of future underperformance.

At the time of writing, the world is following the development of the war between Ukraine and Russia, whose ramifications in the economy, fuel prices, geopolitics, and world trade, in general, are yet to be fully seen. Notably, any impacts, which relate to China, could have possible consequences on global trade.

As already seen in 2021, dynamics in global trade can generate volatility in the price inputs in the PV solar industry, in contrast to the relative stability and more predictable trends in previous years, and thus it is important to monitor and consider potential impacts in the sensitivity analyses of new projects.

In the coming years, the expansion of PV solar energy will continue to drive the massive penetration of renewable energy in energy markets around the world. However, as previous generations of utility-scale PV solar projects and solar PV technologies reach maturity, an increasingly rigorous analysis of all the factors affecting their future performance will be necessary. Similarly, it is essential to keep an eye on the current performance of existing projects compared to the initial assumptions. The joint work of the different players in the market, such as investors, independent power producers, and independent engineers with visibility on numerous projects, will be essential to reduce the risks of underperformance by introducing reasonable adjustments duly based on the models.

References

[1] U.S. Energy Information Administration (EIA), “Solar power and batteries account for 60% of planned new U.S. electric

generation capacity”, 07 March 2022, https://www.eia.gov/todayinenergy/detail.php?id=51518

[2] Rystad Energy, “Most of 2022’s solar PV projects risk delay or cancelation due to soaring material and shipping costs”, 26

October 2021 https://www.rystadenergy.com/newsevents/news/press-releases/most-of-2022s-solar-PV-projects-risk-delay-or-cancelation-due-to-soaring-material-and-shipping-costs/

[3] Sean Rai-Roche, “Module prices to remain elevated for 18 months at least as global demand skyrockets”, PV-Tech, 10 March

2022, https://www.pv-tech.org/module-prices-to-remain-elevated-for-18-months-at-least-as-global-demand-skyrockets/

[4] Alex Koshulko, “Shipping container crisis 2021”, GHDH, January 13, 2022, https://gmdhsoftware.com/shipping-container-crisis-2021/

[5] IHS Markit, “Global Power and Renewables Research Highlights, February 2022”, 15 February 2022,

https://ihsmarkit.com/research-analysis/global-power-and-renewables-research-highlights-february-2022.html

[6] kWh Analytics, “Solar Risk Assessment: 2021”, https://www.kwhanalytics.com/solar-risk-assessment