Energy Storage

Deep power industry and technology expertise

The development of low-cost and responsive battery-energy systems has allowed today’s energy producers and electricity providers to better adapt to swiftly fluctuating market needs and continue the replacement of fossil fuel-derived electricity with electricity from renewable energy sources. The value of battery storage devices lies in their ability to help maintain grid stability and balance intermittent, renewable electricity production — critical to matching the timing of customers’ demand.

Energy storage is not a new concept but has enjoyed increased interest in recent years due to its ability to enable intermittent energy sources to integrate into the grid at higher levels. Evolving market rules, cost reductions and government incentives have allowed battery energy storage systems (BESS) to join pumped hydroelectric as a grid-scale energy storage contributor. Often paired with solar facilities and wind farms, BESS takes advantage of otherwise lost opportunities to optimize energy and ancillary service revenues.

Lummus Consultants’ capabilities in this arena help customers explore and capitalize on the value in this growing technology space.

Capabilities across the value stream

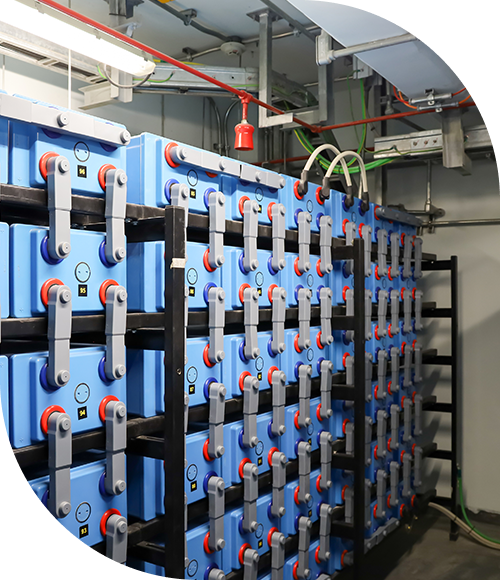

Lummus Consultants has played a key role in the development and financing of energy storage projects, with technologies that range from hydro-pumped storage to BESS and compressed air storage. Our project experience includes numerous battery energy storage designs and technologies, and our experts stay up to date on the advancement of BESS technology through BESS packagers and original equipment manufacturers.

Our consultants are well versed in all aspects of battery storage projects, including battery storage procurement, EPC contract terms, performance, the effects of battery degradation and augmentation approach, the cost to support long-term reliable operation, fire prevention system requirements, permitting, and integration of the BESS to the grid or local off taker.

As an integral part of the project advisory team, we work to confirm that BESS project technical, commercial and environmental risks are appropriately identified and mitigated, a critical element to project development and securing project financing. We have provided technical advisory services to clients in the evaluation of acquiring BESS portfolios as well as project financing technical due diligence services for new construction of facilities up to 250 MW.

Support for your battery storage projects

Properly assessing battery storage technology and solutions requires a combination of technical expertise with battery technologies and power project experience. BESS projects and applications come with unique challenges and business goals. Our experts effectively identify project risks and assess mitigation measures as well as identify possible opportunities in this growing technology area.

Our energy storage experience is both deep and broad, including serving as an advisor for the construction of what will be one of the largest installed BESS projects in the world. No matter the size or complexity of your project, our experts bring valuable insight and expertise.

Comprehensive services across the project cycle

Toward net zero

Our results speak for themselves

LET’S TALK

What is your energy storage challenge?

Lummus Consultants.